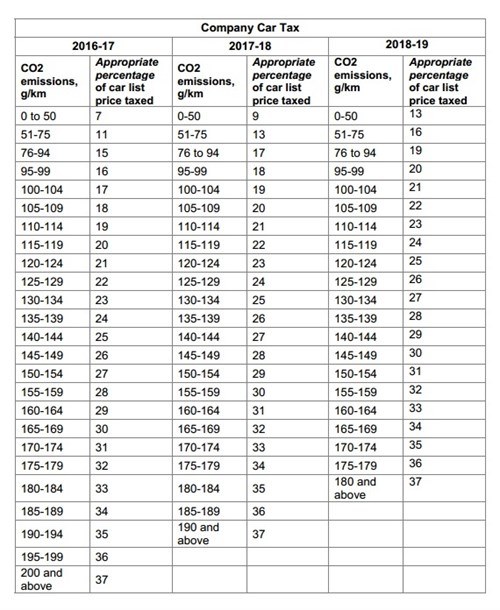

Due to the continued short sighted view from the treasury this will make ALL cars emitting under 50 Co2 be in the same 13% Company Car Tax band by 2018. Ouch Ouch Ouch

On a personal level this may impact my next car choice when my car is up in August 2015 as the compelling business case just significantly eroded.